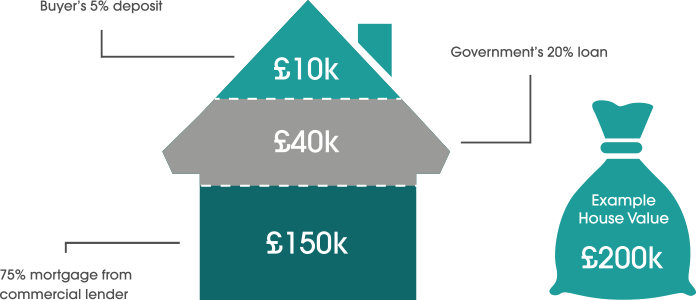

With Help to Buy you could buy a brand-new home with just a 5% deposit. The Government then lends you a 20% equity loan, leaving you to take out a mortgage of just 75%

More Help to Buy

-

- Help to Buy is a Government-backed scheme. Those looking to buy a new home, whether first time buyers or existing home owners, only need a 5% deposit to buy a new Marble Home within England and qualify for some of the best mortgage interest rates available.

- Use the calculator below to enter the value of the property you’re interested in; this will indicate how much the Government may be able to lend based on your deposit and is calculated on the basis that the Government will offer a loan equating to 20% of the total purchase price.